An Analysis of Profit and Customer Satisfaction in Consumer Finance

Abstract

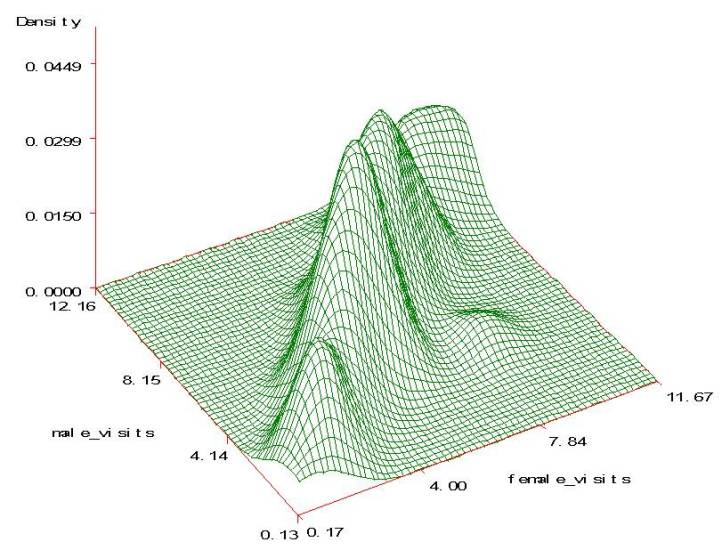

This study investigates a set of bank data from a cost/profit perspective. In this specific case, the bank would like to know whether prospective consumers will pay back their credit. The common practice is to calculate the probability that a consumer with certain covariates is to be considered as a potential risk. Our study will go further in the use of the probabilities to maximize the profit. In addition, we will show that the same technique can be used to improve customer satisfaction. The technique should be equally applicable in other consumer markets including auto loans, credit cards, mail catalog orders, home mortgages, and a variety of personal loan products provided by insurance firms, mobile phone companies, and other lending institutions. This case is accessible to readers with an intermediate level of statistics.Downloads

Additional Files

Published

2014-08-26

Issue

Section

Articles